Daily / Casual payment earners hardest hit

The index shows the category hardest hit with loss of earnings were individuals in the Daily / Casual payment earners (-35.2%) and weekly wage earners (-17.1%).

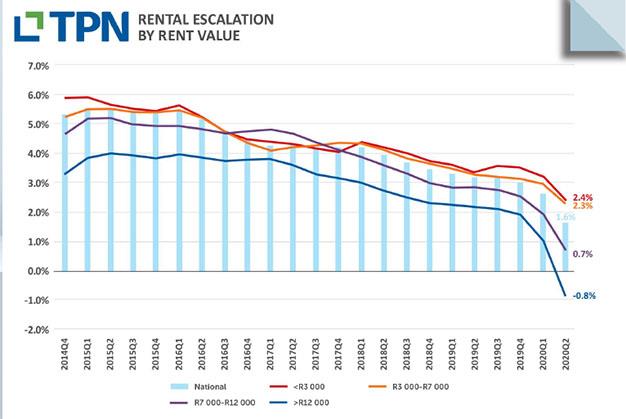

This has intern had the biggest impact on the low-end of the rental market. Interestingly, this segment showed increasing market strength as the demand for < R3,000 increased. Sadly for these tenants, only 63% are in good standing with their rent which means high risk applications and more tenants not qualifying.

No sector of the rental market was left unscathed with double digit vacancies across the board, according to TPN. Although affordable properties in the R4,500 to R7,000 and R7,000 to R12,000 range with 10.31% and 10.34% vacancies respectively the least impacted.

Most affordable cities for South Africans to rent property?

It appears that the cost of accommodation in the country’s major cities is still on the rise. In May 2019, Adzuna, an online job aggregator, established that South Africans were spending roughly 28% of their salaries on rent. This year, after comparing average rental prices and wages of more than 100 000 online job listings, they were able to point out areas where it would be most cost-effective for South Africans to live and work.

|

City |

Average Rent |

Average Salary |

% of Salary Spent on Rent |

|

R6,500 |

R33,000 |

19% |

|

|

R8,000 |

R37,000 |

20% |

|

|

R10,000 |

R38,000 |

27% |

|

|

R7,500 |

R31,000 |

24% |

|

|

R4,500 |

R30,000 |

15% |

|

|

R5,600 |

R29,000 |

19% |

|

|

R5,000 |

R28,000 |

20% |

|

|

R5,500 |

R32,000 |

17% |

|

|

R5,000 |

R30,000 |

16% |

|

|

R4,500 |

R22,000 |

20% |

"A comparison was drawn between the average salary and the average property value in each of the country’s main city centres. The findings were indicative of the fact that most households spend anything between 16% and 27% of their monthly income on rent.

According to Adzuna analysis of income and rental prices in 10 of the country’s major cities, "the most affordable cities to rent in came out as Bloemfontein, Polokwane, Rustenburg, Nelspruit, and Pretoria."

"With more and more remote jobs in South Africa, where you stay is less and less connected to where you work. Even though salaries in Cape Town are higher, renters in the Western Cape fork out as much as 27% of their wages on rent every month."

On the opposite end of the scale, Cape Town is still the most expensive city for renting a property in the country, unchanged since May 2019. Capetonians spend an average of 27% of their salaries on rent every month if they choose to live just outside the city centre. Rental costs within the city’s centre are even more expensive and can easily demand up to 35% of a renter’s monthly earnings.

TPN data shows that there is an excess supply across South Africa's rental market, with the most affect areas being Gauteng and Western Cape.

Market strength drives vacancies, and as the TPN Market Strength Index confirms demand is drying up coupled with plenty supply on offer. For those tenants with an income, it is a tenants market. Landlords should brace themselves for price negotiation and competing tenant incentive take-on benefits like zero deposit, first month rent free, new appliances and free WIFI.

When considering where to rent property in South Africa, low rental prices should not be the only factor that South African families base their decisions on, suggest Adzuna.

"It is also essential to consider how many jobs are on offer in the area you intend to live in and what the average salary demographics look like. The average salaries in areas like Polokwane and Rustenburg, for example, is affected by the mining and technical sectors, which pay higher than average wages. Still, not everyone will be able to secure employment in this field.

"Cities like Nelspruit and Pretoria tend to provide excellent value for renters, offering enough job opportunities and rental costs at or below 20% of monthly earnings. Destinations like Cape Town will see renters forking out the most significant chunks of their earnings towards rent every month."