As we deal with the Third Wave of the Covid-19 pandemic, South Africans are being warned to remain vigilant. All eyes are firmly fixed on the roll-out of the country's vaccination plan, with just over 1.3% of the adult population – mostly medical staff – fully vaccinated.

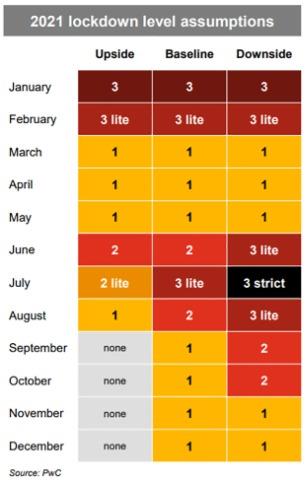

The threat of tighter lockdown restrictions remains on a knife's edge as confirmed cases, especially in Gauteng rise. A recent PwC South Africa economic forecast for the country shows exactly what the COVID-19 lockdown restrictions could look like in the near term, with restrictions only expected to ease from September.

Based on three different forward-looking scenarios, the projected data shows a still-wide range of possible economic outcomes in 2021-2022 as lockdown changes play out - with baseline economic growth of 3.7% in 2021 outlined.

"In our upside scenario, less strict lockdown rules and a slowdown in electricity load shedding in the remainder of the year could boost real GDP growth to more than 5.9% during 2021," says Lullu Krugel, PwC South Africa's Chief Economist.

economic growth – in particular from April onwards – will be due to the base effects arising from the large contraction in economic activity last year during the second quarter.

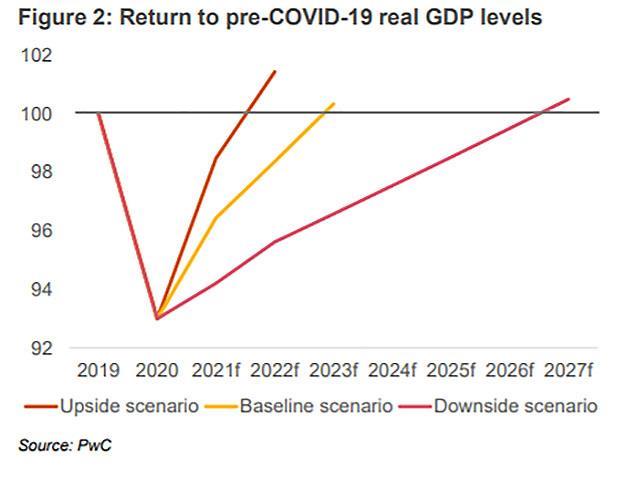

Projections show the South African economy will only return to its pre-pandemic size by 2023 – or even later.

"It could happen sooner under the upside scenario, though at the same time a sluggish recovery under the downside scenario could see the timeline extended to 2027. Amongst the alternative alternatives, we currently see the downside

scenario as slightly more likely than the upside narrative," says Krugel.

READ: What you need to know about SA's rapidly escalating municipal charges

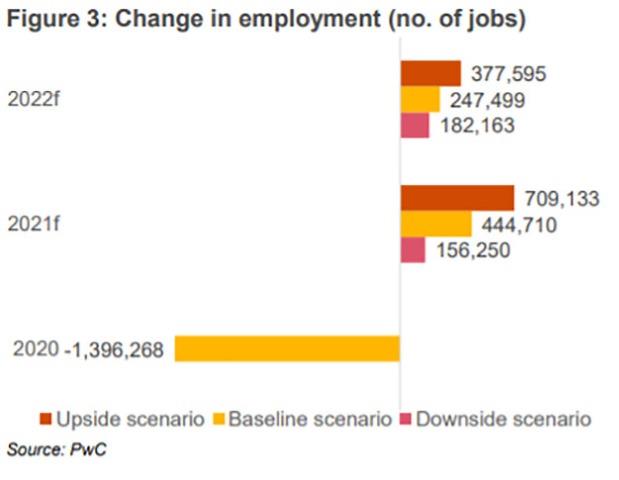

This as unemployment levels languish, and expected to reach pre-pandemic levels only by 2025. Load shedding and South Africa's electricity shortages again weighs heavily on the projected employment outcomes as detailed by PwC.

“We estimate that, by the end of this year, total employment should be at a similar level to that seen in 2015. Our economic forecasts suggest South Africa will recover 444,710 jobs in 2021.

“By our estimates, this number could have been closer to 650,000 were it not for the adverse impact of electricity load shedding.

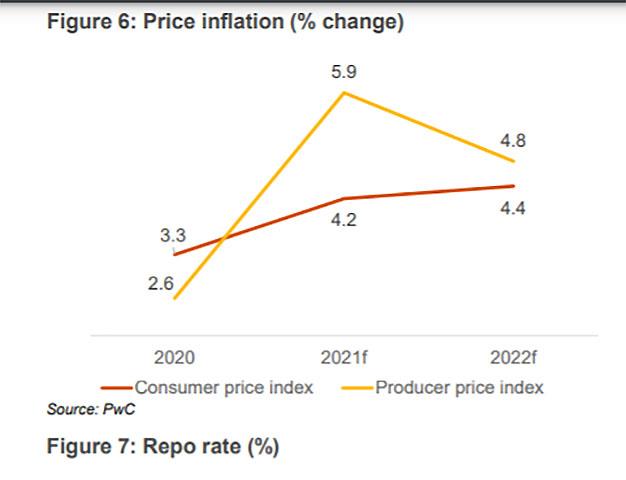

On a more positive note, current inflation dynamics should allow the central bank to keep lending rates on hold for the remainder of 2021, adds Krugel.

"We expect inflation to average a moderate 4.2% in 2021, and a slightly higher 4.4% in 2021 – both very close to the mid-point of the 3%-6% target range that the SARB is currently favouring. The current inflation environment will enable the SARB to keep interest rates at a record-low for now.

"However, it cannot indefinitely delay the start to monetary policy normalisation – the central bank has already signalled that that next rate adjustment will be upwards. We believe the central bank will wait until early in 2022 to start lifting lending rates, and to raise the repo rate by a cumulative 0.5 percentage points."

READ: When is South Africa's interest rate likely to increase?